Hello everyone, I am Kasanje-카산제.

I just wanted to give an update on my current portfolios and generally where I am with my varied investments. Gains and Losses and how I am planning on investing in this new year of the black tiger.

First, though, I should offer some background information for context. I am currently living essentially rent-free in a family home owned by a relative.

I try to live simply and keep my expenses low. I resigned from my retail job of 11+ years in 2020 and have been unemployed since.

I decided to go back to college last year and am currently enrolled full-time at a local community college.

The FAFSA, plus other financial aid, more than covered my tuition needs and left me with a sizeable chunk of change left over.

I know it has been some time since I last posted anything about #investing, but I had some good news today, so I will get right into it.

I use five different brokerage apps to manage my portfolios.

On Webull, I have all of my speculative stocks, including picks from Green Energy, Hotels, Space, IPOs, Electric Cars, and DOGE/SHIB.

This account started out with around $3,000 back in 2019, and currently, it sits at a value of $1,884.

It was mostly downhill until COVID-19 hit, and then I started to crawl my way back up.

Still, though I am looking at everything I hold being RED.

On Sofi, I have two dividend-paying stocks: Credit Suisse Silver (SLVO) and Orchid Island (ORC).

The rest of the portfolio includes SPACs that I thought had potential and a few Meme stocks, including Genius Brands International (GNUS) and Ocean Power Technologies (OPTT).

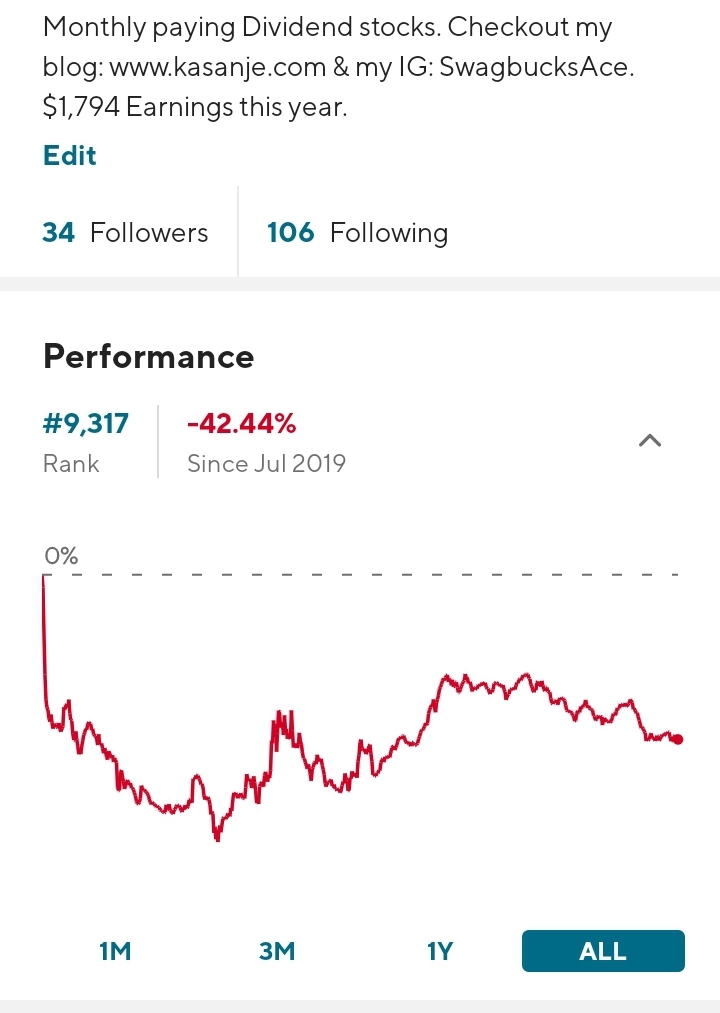

I’ve had the account since July 2019 and am down 42% unfortunately. Last year, I liquidated my HSA account from work and tossed the lot into Sofi, which put me at around $25k account value.

That number has dropped, and I now sit around $15k, which has been somewhat painful. I have earned around $1,990 in dividends, though.

My Charles Schwab brokerage includes funding from a home business mining the cryptocurrency Litecoin (LTC).

Sadly, I had to stop mining in 2020 and eventually shut down in 2021. I have an SBA loan from disaster relief financing that I am currently paying off using the dividends from Schwab. (Schwab won’t let you take screenshots as a security precaution.)

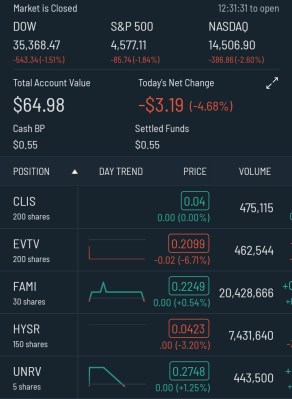

I have an account with Firstrade, which holds all of my OTC market stock.

I have small investments in ClickStream (CLIS), Farmmi (FAMI), Hyper Solar (HYSR), Envirotech Vehicles (EVTV), and Unrivaled Brands (UNRV).

These are all long-term plays, and I don’t check in on them all that often.

The last one is Robinhood.

I had some Green Energy stocks and Cannabis stuff in here for a long time, and they really didn’t fare well.

I also did crypto for a bit and failed. It is very RED in this portfolio. I think back in November 2021, I heard about Renaissance Technologies and the dividend stocks that were included in their portfolio.

That got me inspired, and I made a Watchlist on Webull that included all of those stocks.

I have started closing my GREEN positions at Robinhood and moving the funds into the Renaissance Dividend list.

Robinhood started with $1,935 in 2017 and is currently UP 3.32%, but used to be much higher.

For my future plans around investing, I recently threw the bulk of my Schwab cash into Retail Value (RVI), which is paying out a special dividend tomorrow of $3.27 per share.

I was able to buy 780 shares and am expecting a return of $2,550.50 from that, which should be enough to clear the SBA loan in full.

I will continue to chase dividends with the Schwab account. I have also been playing around with new YouTube and Instagram accounts to explore other topics I am interested in.

The *** is one of the more popular pages that gets a lot of traffic, and so I made YouTube/Instagram pages for it.

If you are not already a member of Swagbucks, MyPoints, or InboxDollars, I strongly suggest you sign up. These sites are a great source of extra income for spontaneous purchases.